US Sanctions Hong Kong Chief Executive And Beijing “Puppet” Carrie Lam

ZeroHedge - Aug 7th 2020 9:24am EDT

Chinese Military Commander Confronts Esper About America’s “Dangerous Moves”

ZeroHedge - Aug 7th 2020 9:11am EDT

‘Global Splintering’ Escalates Amid “Delusional” Markets

ZeroHedge - Aug 7th 2020 8:52am EDT‘Global Splintering’ Escalates Amid “Delusional” Markets Tyler Durden Fri, 08/07/2020 – 08:52 Authored by Michael Every via Rabobank, For those who don’t read this Daily regularly, I have been warning that the US and China were heading for a real Cold War since late 2017, and I have been stating openly that the US was […]

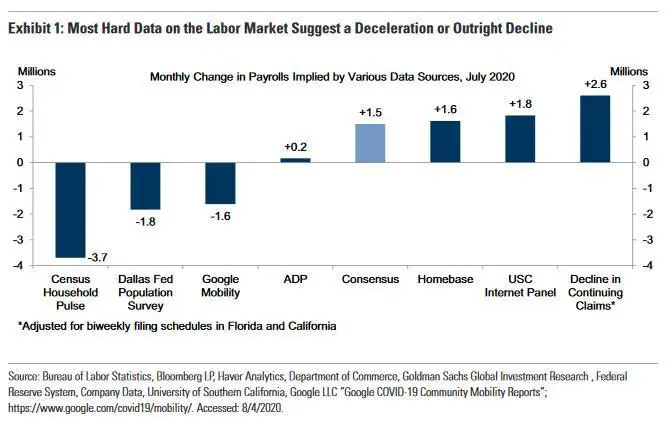

Trump Was Right: “Big” Payroll Number Smashes Expectations As 1.76 Million Jobs Added

ZeroHedge - Aug 7th 2020 8:39am EDT

If The “Market” Never Goes Down, The System Is Doomed

ZeroHedge - Aug 7th 2020 8:25am EDT

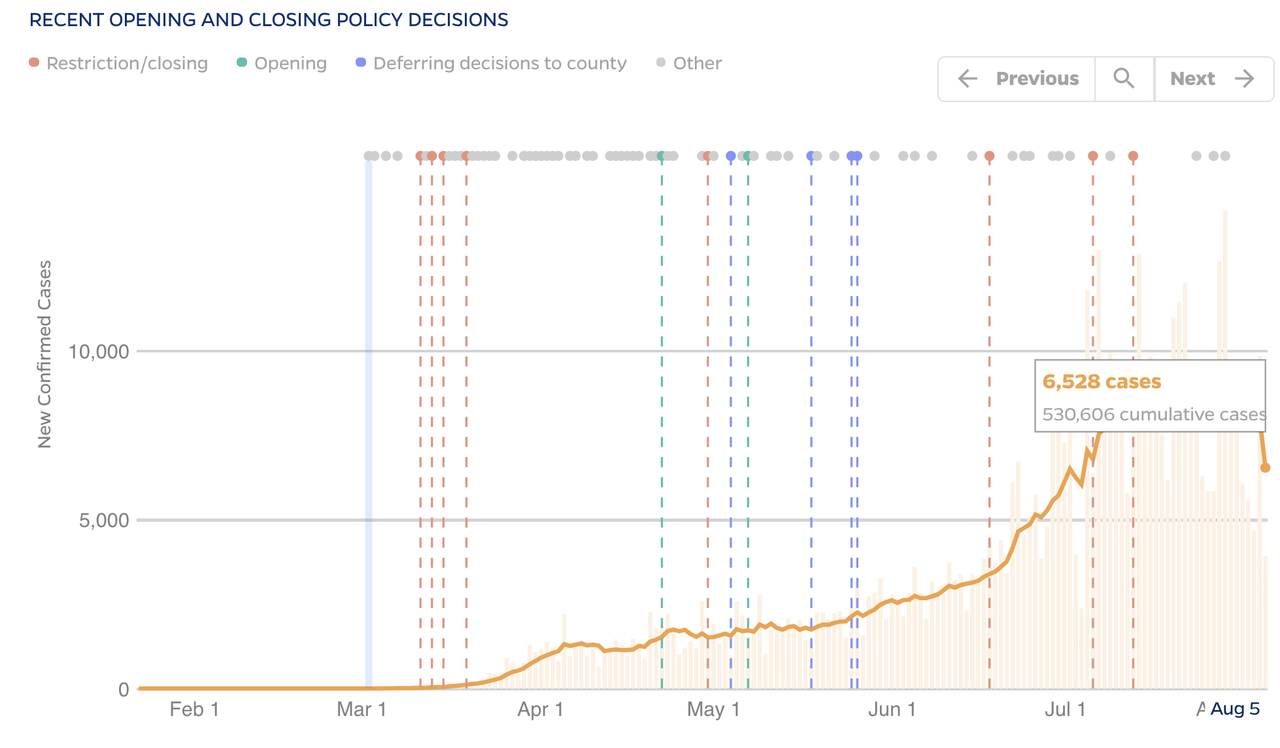

California Struggles To Fix Under-Counting ‘Bug’ As Global COVID-19 Cases Top 19 Million: Live Updates

ZeroHedge - Aug 7th 2020 8:13am EDT

Goldman’s ‘Blockbuster’ Q2 Profits Erased By $2 Billion Legal Provision, Bank Says

ZeroHedge - Aug 7th 2020 7:37am EDT

Futures Slide After Trump Opens A “Most Unwelcome Can Of Worms” With TikTok, WeChat Executive Order

ZeroHedge - Aug 7th 2020 7:19am EDT

TikTok “Shocked” By Trump Ban, Insists Order “Undermines Trust In Rule Of Law”

ZeroHedge - Aug 7th 2020 7:02am EDT

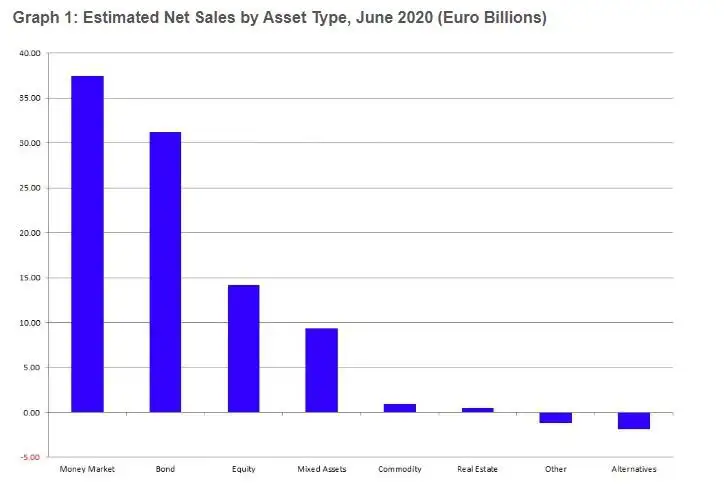

European Funds Post Stunning $835 Billion In Trading Losses For First Half Of 2020

ZeroHedge - Aug 7th 2020 5:30am EDT

Von Greyerz: The Nightmare Scenario For The World

ZeroHedge - Aug 7th 2020 5:00am EDT

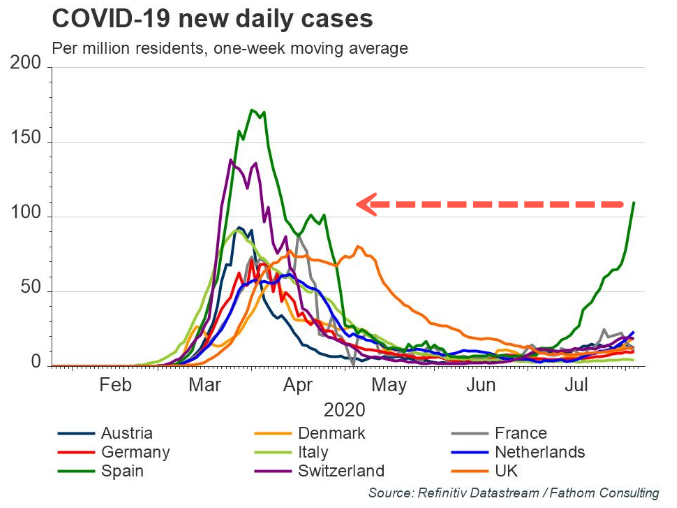

Spain’s Virus Cases Surge, Lockdown Imposed, Investors Derisk Stocks

ZeroHedge - Aug 7th 2020 4:15am EDT

Danish Immigration Minister Admits Integration Policy Is A “Fiasco”

ZeroHedge - Aug 7th 2020 3:30am EDT

Chinese Drones Now Deployed In Balkans After Serbia Deal – NATO On Edge

ZeroHedge - Aug 7th 2020 2:45am EDT

China And The EU Vie For Hydrogen Supremacy

ZeroHedge - Aug 7th 2020 2:00am EDT

Meanwhile, In Russia…

ZeroHedge - Aug 7th 2020 1:00am EDTMeanwhile, In Russia… Tyler Durden Fri, 08/07/2020 – 01:00 A naked man standing in the middle of a bustling Russian street received a stiff knuckle sandwich from a driver who was clearly feeling a little impatient that day. Cell phone video shows the pudgy naked man strolling down the middle of a street as cars […]

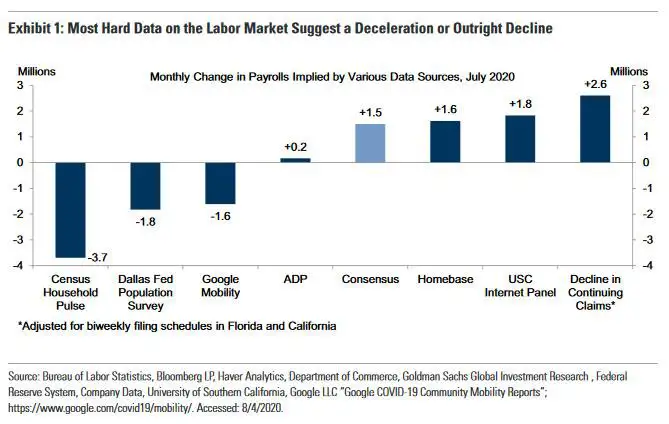

Payrolls Preview: Just How “Big” Will Friday’s “Big Number” Be

ZeroHedge - Aug 6th 2020 11:30pm EDT

Russian S-300 Air Defense System Spotted In Libya?

ZeroHedge - Aug 6th 2020 11:05pm EDTRussian S-300 Air Defense System Spotted In Libya? Tyler Durden Thu, 08/06/2020 – 23:05 Submitted by SouthFront Russia has deployed an advanced S-300 air defense system to Libya to support the forces of Field Marshal Khalifa Haftar against the Turkish military and its proxies, local media reported on August 5. According to photos surfacing online, […]

The Bogus “Recovery”, Stress, & Burnout

ZeroHedge - Aug 6th 2020 10:35pm EDT

‘Kansas Should Go F*** Itself’: Taibbi Opines On Liberal Arrogance In Lieu Of Introspection

ZeroHedge - Aug 6th 2020 10:05pm EDT‘Kansas Should Go F*** Itself’: Taibbi Opines On Liberal Arrogance In Lieu Of Introspection Tyler Durden Thu, 08/06/2020 – 22:05 “America’s financial and political establishment has always been most terrified of an inclusive underclass movement. So it evangelizes a bizarre transgressive politics that tells white conservatives to fuck themselves and embraces a leftist sub-theology that […]

Trump Signs Executive Order Banning TikTok, WeChat

ZeroHedge - Aug 6th 2020 9:50pm EDTTrump Signs Executive Order Banning TikTok, WeChat Tyler Durden Thu, 08/06/2020 – 21:50 President Trump signed an executive order banning U.S. residents from doing any business with TikTok or the apps’ Chinese owner ByteDance 45 days from now. Trump said the U.S. “must take aggressive action against the owners of TikTok to protect our national […]

Freddie Mac Warns Apartment Loan Supply May Plunge As Virus Crushes Working-Poor

ZeroHedge - Aug 6th 2020 9:25pm EDT

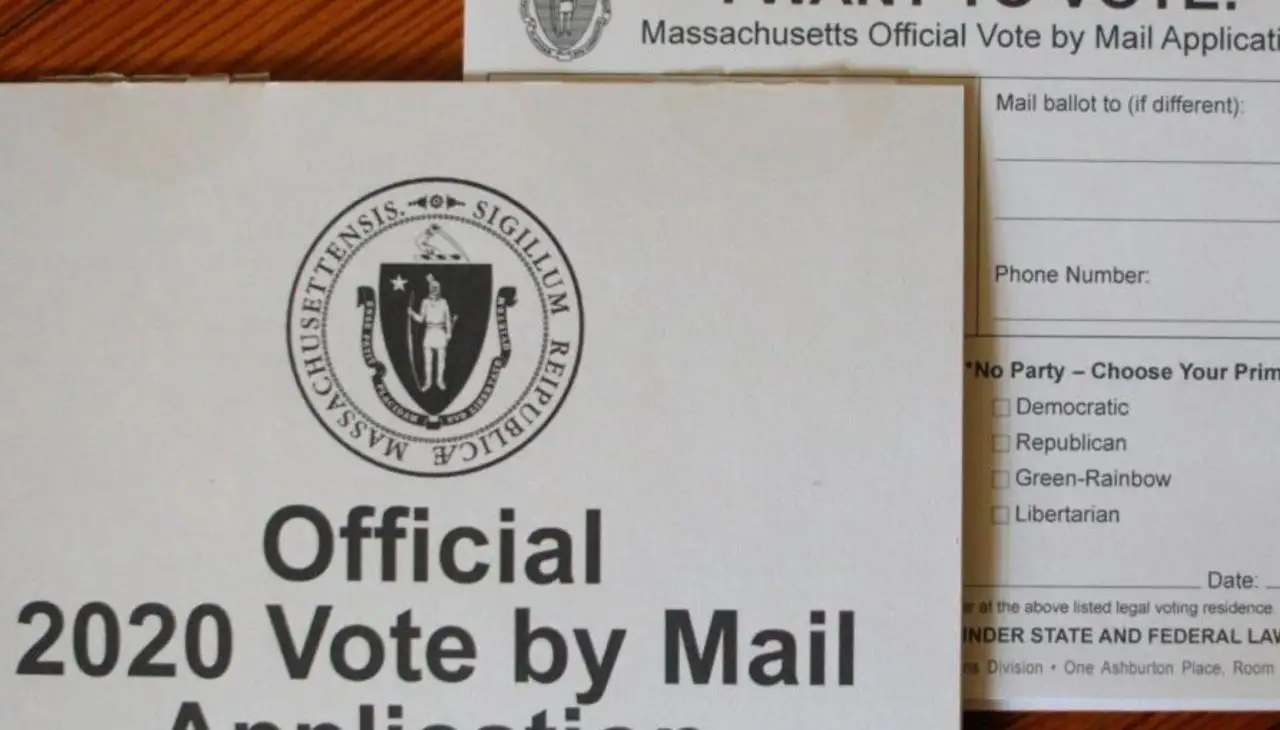

Voting Fraud Is Real: The Electoral System Is Vulnerable

ZeroHedge - Aug 6th 2020 9:05pm EDT

Walmart Is Turning Its Parking Lots Into Drive-In Movie Theaters For Its Customers

ZeroHedge - Aug 6th 2020 8:45pm EDT

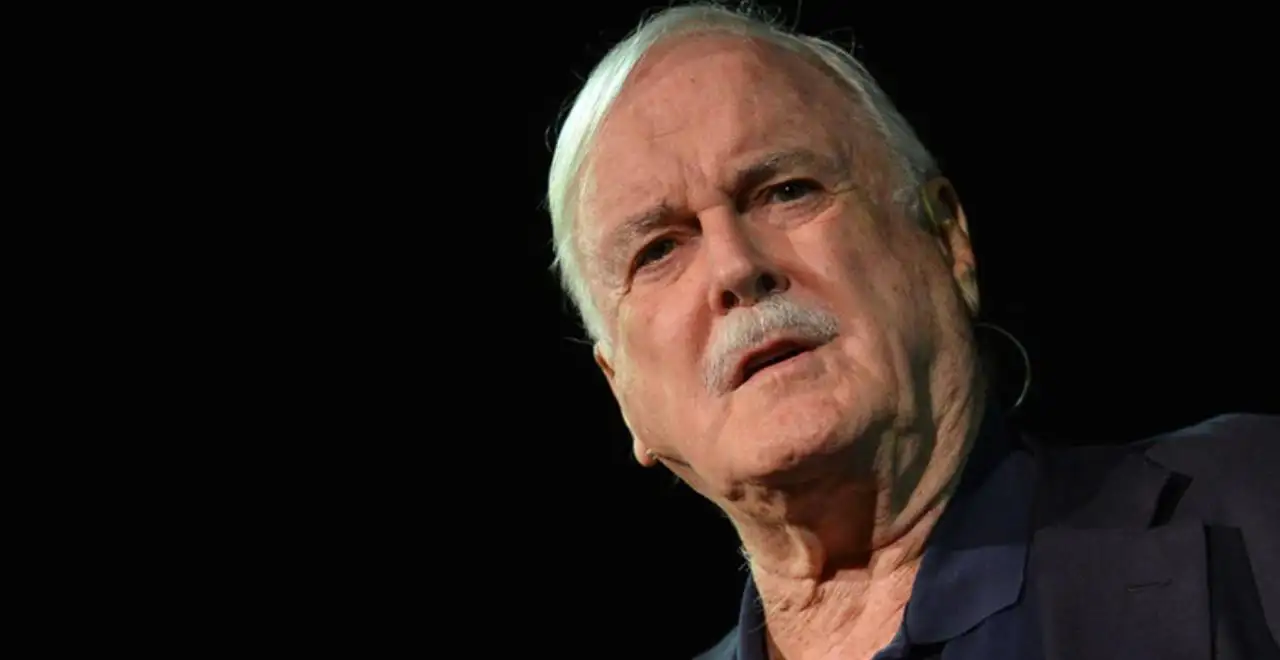

John Cleese: Woke People Have “Zero Sense Of Humour”; They’re Killing Comedy

ZeroHedge - Aug 6th 2020 8:25pm EDT