Bankrupt Oil Company Trolls Its Banks, Says They May Fail Too

ZeroHedge - Mar 26th 2020 6:41pm EDT

Chicago Mayor Warns, Those Who Go Outside To Exercise Risk Arrest

ZeroHedge - Mar 26th 2020 6:25pm EDT

Is There Wasteful Spending In The Coronavirus Stimulus Bill? (Spoiler Alert: Bigly!)

ZeroHedge - Mar 26th 2020 6:05pm EDT

Insanity: Stocks Enter New Bull Market On Day Initial Claims Hit 3.3 Million

ZeroHedge - Mar 26th 2020 6:00pm EDT

Disaster Looms As Millions Of Americans Set To Lose Employer-Sponsored Health Insurance

ZeroHedge - Mar 26th 2020 5:45pm EDT

Cuomo Approves ‘Splitting’ Of Ventilators As Some COVID-19 Patients Stay Intubated For Up To 30 Days

ZeroHedge - Mar 26th 2020 5:15pm EDT

Corporate Socialism: The Government Is Bailing Out Investors & Managers, Not You

ZeroHedge - Mar 26th 2020 4:54pm EDT

Fitch Warns “Risk Of Near-Term Negative Rating Action” On USA Has Risen

ZeroHedge - Mar 26th 2020 4:41pm EDT

Tudor Jones: Market To Retest Lows Before Summer Rebound After COVID-19 “Throws Its Best Punch”

ZeroHedge - Mar 26th 2020 4:25pm EDTTudor Jones: Market To Retest Lows Before Summer Rebound After COVID-19 “Throws Its Best Punch” After years of subpar returns and wrong-way bets, hedge fund manager Paul Tudor Jones, a trader known for his slam-dunk trades during the 1987 crisis, and again during the financial crisis, is once again having a moment. After telling CNBC […]

S&P Futures Explode 40 Points Higher In One Tick On $7 Billion Market On Close Imbalance

ZeroHedge - Mar 26th 2020 4:01pm EDT

Kathy Griffin Hospitalized With “Unbearably Painful” Symptoms, Blames Trump

ZeroHedge - Mar 26th 2020 3:45pm EDT

Tax-Dodging Cruise Industry Begs For Taxpayer Bailout Amid Collapse In Revenue

ZeroHedge - Mar 26th 2020 3:40pm EDT

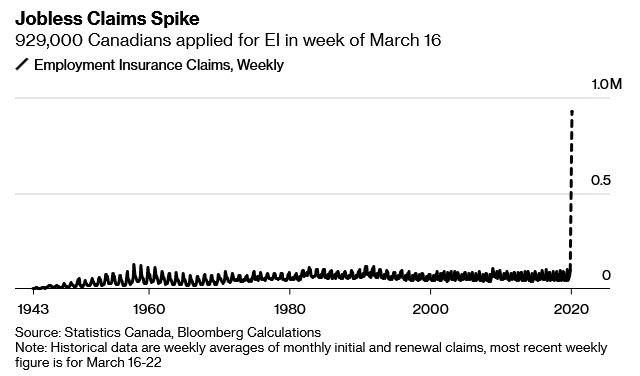

“I’ve Never, Ever, Ever Seen Anything Like This Before”

ZeroHedge - Mar 26th 2020 3:30pm EDT

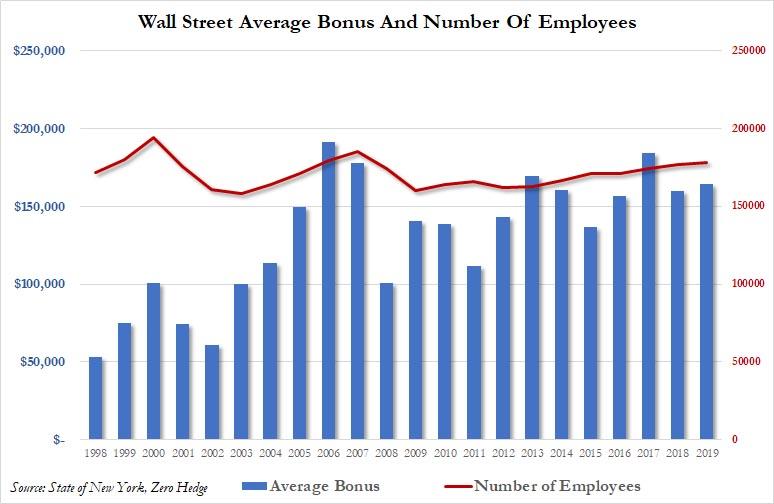

To Boost Morale, Citi And Morgan Stanley Halt Layoffs With Banker Bonuses Set To Tumble

ZeroHedge - Mar 26th 2020 2:40pm EDT

Fast-Charging Stations Damage Tesla Car Batteries After Just 25 Cycles, New Study Shows

ZeroHedge - Mar 26th 2020 2:40pm EDT

Bezos And Other Corporate Execs Sold Billions In Stock Before COVID-19 Rocked Market

ZeroHedge - Mar 26th 2020 2:25pm EDT

US Vehicle Sales Volumes Are Down 50%-75% In March

ZeroHedge - Mar 26th 2020 2:10pm EDT

“It Is Likely Too Soon To Declare A Lasting Bottom”

ZeroHedge - Mar 26th 2020 1:55pm EDT

Oil Plunges After IEA Hints Russia, Saudis Would Need To Completely Halt Production To Balance The Market

ZeroHedge - Mar 26th 2020 1:52pm EDT

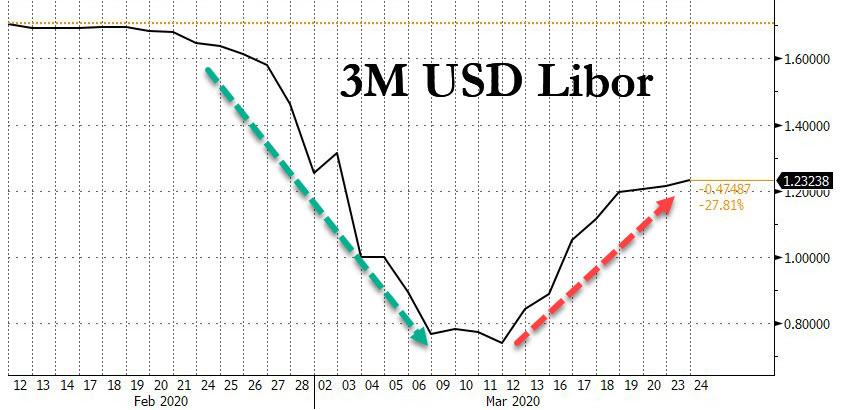

Bizarre Rise In Libor Prompts Questions About One Or More Banks In Trouble

ZeroHedge - Mar 26th 2020 1:40pm EDT

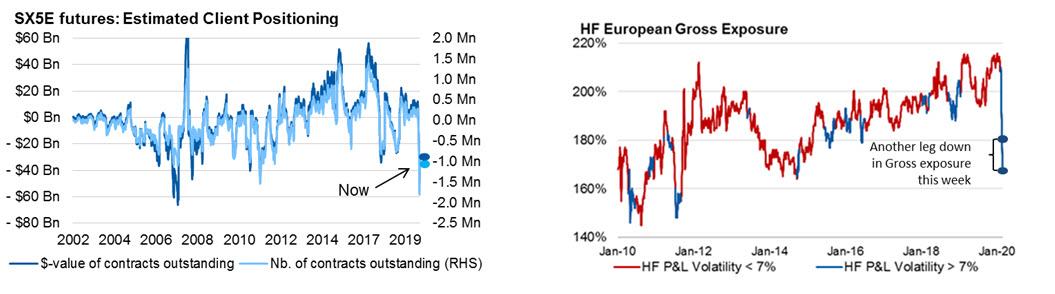

Morgan Stanley: “We Are Underwhelmed By This Low Participation Rally”

ZeroHedge - Mar 26th 2020 1:29pm EDT

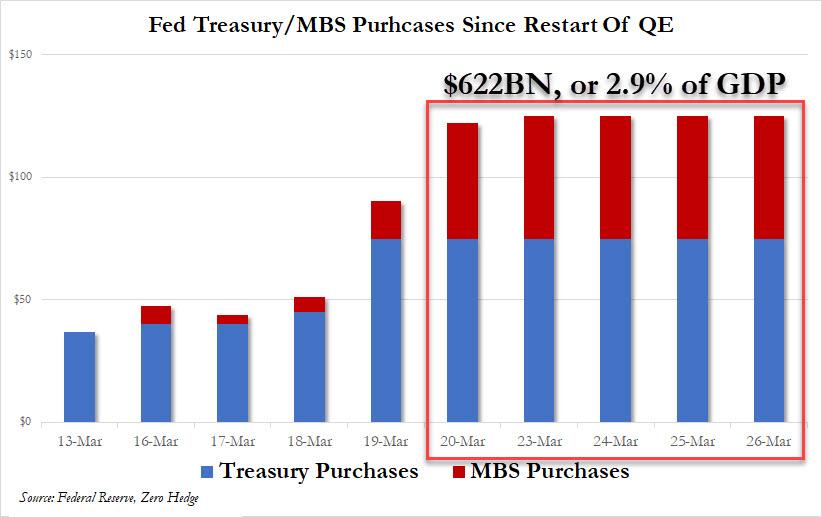

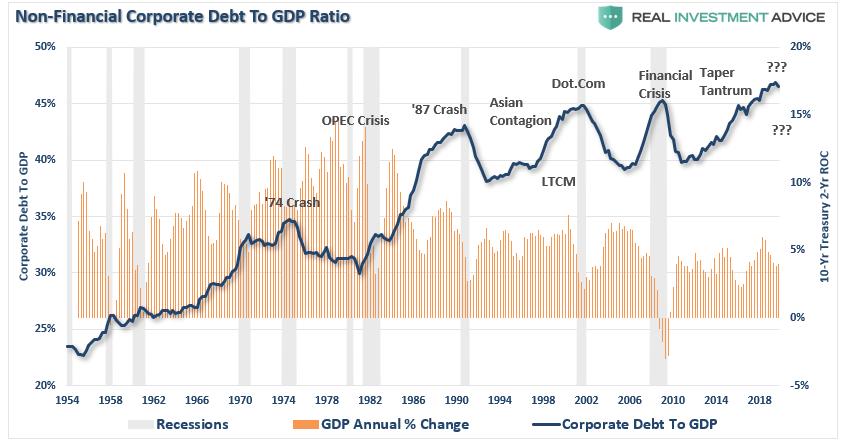

Is The Fed Trying To Inflate A 4th Bubble To Fix The Third?

ZeroHedge - Mar 26th 2020 1:25pm EDT

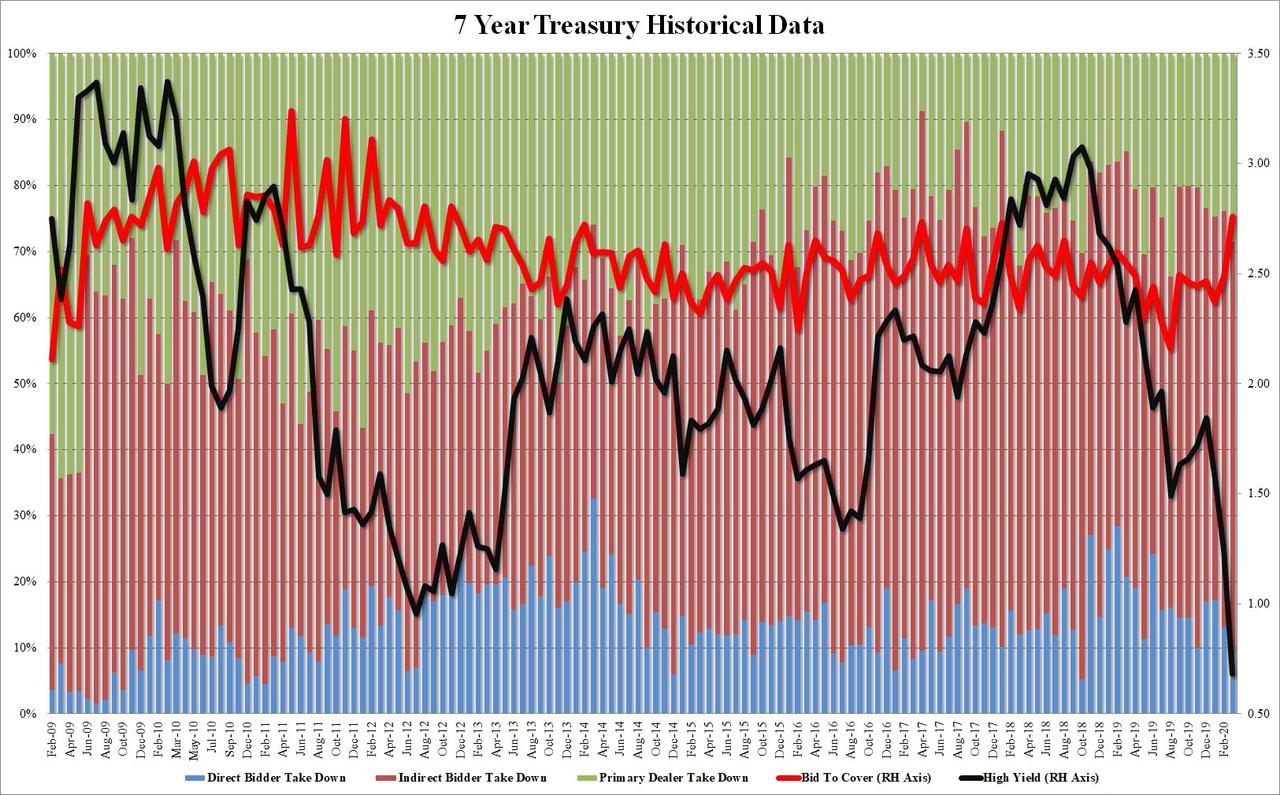

7 Year Auction Prices At Lowest Yield Ever Amid Blockbuster Demand

ZeroHedge - Mar 26th 2020 1:16pm EDT

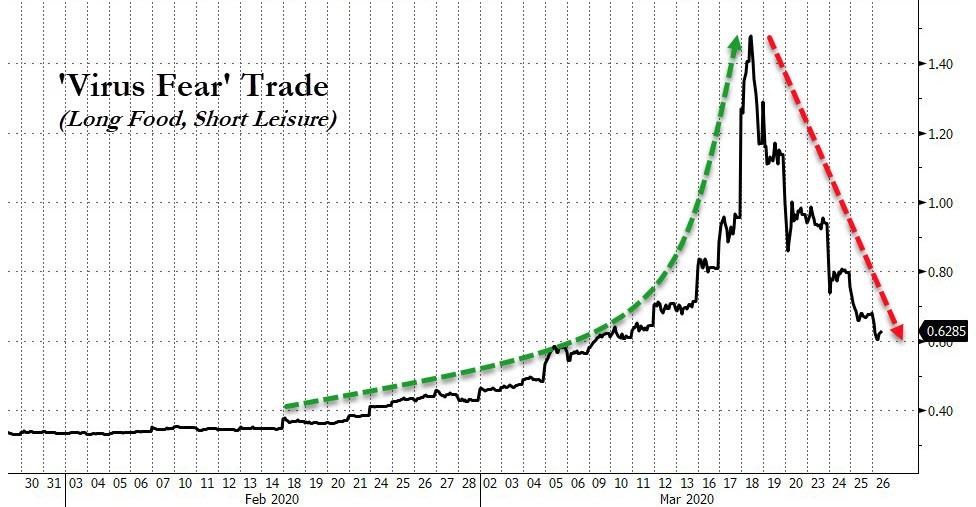

Traders Betting That “$850BN Buyer” Is In The Market

ZeroHedge - Mar 26th 2020 1:10pm EDT

El-Erian: The Race Between Economics & COVID-19

ZeroHedge - Mar 26th 2020 12:55pm EDT